Lead Generation in Thailand: 7 Mistakes Foreign Teams Keep Making

📅 Published: May 29, 2025 ; Updated Nov 27, 2025 | ⏱️ 10–12 min read

Why Lead Generation in Thailand is Different

We’ve been running lead generation campaigns in Thailand for some time now. Our team has worked with local clients across SaaS, logistics, and finance industries. We’ve tested different cadences, adjusted for tone, and built multi-channel outreach using email, LinkedIn, and phone calls.

Lately, we are noticing that more and more international companies are trying to enter the Thai market. At the same time, more Thai businesses are asking for help with modern outbound. The interest is growing on both sides, but the results often don’t match the effort.

Most of the time, the problem isn’t the product or the pitch..it’s the approach. What works in other markets rarely works the same way in Thailand.

This post breaks down the 7 biggest mistakes we’ve seen foreign teams make when selling into Thailand. It’s based on our real campaign data and 2024–2025 market research.

If you are planning to launch or scale in Thailand, this blog will help you avoid wasting time on the wrong outreach.

Before diving into these common errors, make sure you are equipped with the right foundation. Download our comprehensive Lead Generation Thailand Checklist for a step-by-step guide to success.

- Localized approach wins: Lead generation in Thailand performs best when outreach reflects regional buyer behaviour, Thai business culture, and local communication norms.

- Timing matters: The highest reply rates occur between 1 PM – 4 PM, aligning with Thai mobile usage and decision-maker availability during working hours.

- Platform dominance: LINE (56M+ users) and Facebook (50M+ users) act as critical trust and validation channels for B2B buyers, not just consumer audiences.

- Verification first: 35.6% of Thai buyers seek peer validation or online reviews before responding to cold outreach, prioritising credibility over speed.

- Compliance is non-negotiable: PDPA enforcement is strict, with fines reaching up to 5 million THB for improper consent and data handling practices.

1. Understanding the Thai Market: Beyond generic lead generation strategies

Thailand might look like a single, unified market from the outside. But once you are on the ground, the differences between regions show up quickly in buyer behavior, outreach results, and even reply speed.

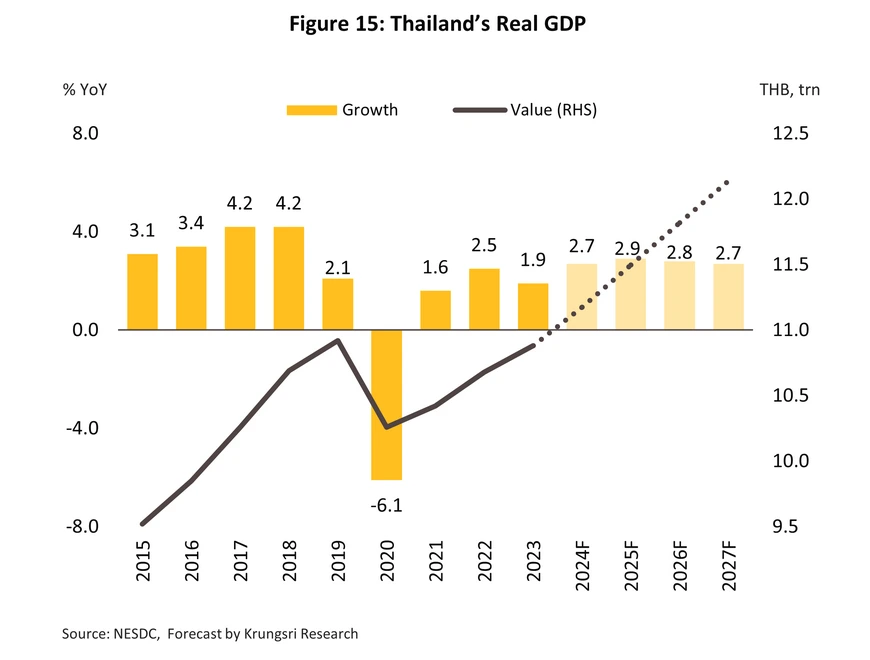

Most teams only build campaigns around the capital city, Bangkok. It makes sense at first as Bangkok alone drives nearly 40 times more GDP than Thailand’s next-largest city. It’s where you’ll find most tech firms, high-growth startups, and enterprise deals.

But focusing only on the capital means missing an entire fast-growing part of the market. Other regions are expanding fast and their buyers behave differently.

Beyond Bangkok, digital consumption is accelerating at a sharp pace. Thailand’s e-commerce market is projected to grow at an estimated 26% CAGR from 2025 to 2033, driven largely by increased internet penetration and mobile-first adoption in provincial regions.

This shift signals why regional targeting now plays a crucial role in lead generation strategy, particularly for businesses targeting manufacturing hubs, industrial zones, and second-tier cities where online purchasing and digital decision-making are rapidly becoming the norm.

Here’s what the numbers show:

In the first 9 months of 2024, the Eastern Economic Corridor (Rayong, Chonburi, Chachoengsao) received over ฿408 billion in BOI-approved investment

These areas are heavily focused on electronics, automotive, logistics, and data infrastructure

Chiang Mai and Khon Kaen are growing in creative, biotech, and sustainable agriculture sectors

Phuket and the southern provinces are seeing steady growth in wellness, hospitality, and travel-tech

Across these regions, outreach habits shift. Some buyers prefer formal emails in Thai. Others expect casual LINE follow-ups, or are more responsive to Thai-language LinkedIn messages. In some sectors, English is expected. In others, it slows the conversation down.

When teams send the same cadence, same message, and same channel mix across all regions, they often get inconsistent results and no idea why.

Success in Thailand starts with knowing where you are selling and who you are speaking to. Local context isn’t just about language, it’s also about industry maturity, decision speed, tone, and trust-building.

Buyers in each region expect you to know the difference. Your outreach should reflect that.

2. Optimizing Outreach Timing: When Thai businesses are ready to connect

We’ve tested outbound campaigns across different time slots in Thailand. Based on our campaign data, the highest reply rates came between 1 PM and 4 PM on weekdays. This window consistently outperformed both mornings and evenings.

That’s when Thai buyers tend to check messages, scroll through LinkedIn, and respond on mobile, especially through LINE and email.

In one of our campaigns, sending outreach campaigns into this time block increased our reply rates by approx. 21%.

This aligns with 2025 engagement data showing Thai business email open rates averaging 23.4%, which is higher than the global B2B average when messages are aligned with mobile usage habits and local working rhythms.

Poorly timed outreach outside this window consistently shows lower visibility and engagement, even when messaging quality remains strong.

Here’s are some other things we’ve learned from repeated testing:

Morning (8–11 AM): Often blocked for internal meetings or operations

Lunchtime (12–1 PM): Light engagement, mixed results

Early afternoon (1–4 PM): Highest engagement across email, LINE, and LinkedIn

Late afternoon (4–6 PM): Slower replies, start of wind-down

Evening (after 6 PM): Usually ignored unless pre-warmed

Foreign teams often schedule messages based on their home timezone or default automation settings. The result is lower visibility and slower response, even if the message is strong.

If you are targeting Thai decision-makers, timing your message for their actual work rhythm is one of the easiest ways to improve results.

3. Cultivating Trust: Crafting personalized lead generation messages for Thailand

Outreach strategies that work in the West don’t always land the same way in Thailand.

Thailand has a deeply relationship-driven culture where tone, respect, and language matter. What feels normal in Western markets (like jumping straight into a meeting request) can come across as rushed or overly transactional here.

We’ve seen outreach campaigns underperform simply because the tone didn’t match local expectations. Common mistakes include:

Opening with a blunt CTA like “Are you free for a 15-minute call?”

Skipping greetings or not using proper titles

Sending auto-translated messages that feel robotic

Asking business questions before any rapport is built

Thai prospects often expect a softer, more respectful approach, especially in the first touch. Even English-speaking execs respond better when there’s a local feel to the message.

Here are a few lines that performed well in our campaigns:

“เรียน คุณ…” (Dear Khun…) > shows respect and familiarity

“สะดวกคุยเบื้องต้นวันไหนดีครับ?” (What day would be good for a quick intro call?) > polite and flexible

“ขอบคุณล่วงหน้าค่ะ” (Thank you in advance) > adds warmth and humility

A 5% email reply rate might jump to 7–8% when tone is adjusted and language is personalized. Our internal testing shows that formal Thai phrasing in the first line of an email can improve open rates by up to 18%.

A little cultural context goes a long way.

4. Leveraging Local Signals: Uncovering intent in Thailand’s digital landscape

Most foreign teams rely on the usual triggers, such as job changes on LinkedIn, Google alerts, or firmographic filters inside CRMs.

But Thai companies don’t always show intent in the same way. Many signals are shared in local platforms, regional press, or government channels that never show up in global tools.

We’ve seen better results when outreach is based on signals that Thai buyers actually care about. These include:

New BOI or SET announcements that mention project approvals, factory expansions, or foreign partnerships

Job postings on Thai sites like JobsDB, JobThai, or WorkVenture that suggest new department builds or sales hires

Tax incentives or tenders published by Thai government agencies or industry boards

Mentions in local business media like BangkokBiz, ThaiPBS, Krungthep Turakij, or regional press

Discussions in Thai-speaking forums or Line groups, where buyers openly ask for vendor advice or peer recommendations

One of our best-performing email intros started with:

“We saw your expansion listed in the September BOI report and thought it might be the right time to reach out.”

Thai prospects would pay more attention when the outreach feels rooted in their context and mostly ignore messages that sound like they were sent to 50 other companies at once.

5. Earning Engagement: Building trust before expecting replies in Thailand

Most sales teams assume buyers will check their website or LinkedIn page before replying. That happens, but in Thailand, it’s rarely the first stop.

Thai decision-makers gather information in ways that don’t always show up in your analytics. Before replying to a message, they often ask peers for recommendations, search for real-world examples, or look for Thai-language reviews.

This behavior is reflected in broader data. 54% of Thai consumers now use search engines as their primary source for product and service research, while 35.6% consistently read reviews before taking action.

If your brand lacks visibility on local Thai platforms, business forums, or review-driven ecosystems, your outreach effectively lacks credibility and remains invisible during their decision journey.

We’ve seen prospects take 3 to 5 steps before deciding to engage and most of those steps happen off-platform.

Here’s where Thai prospects typically look for vendor validation:

Private Line groups where business leaders trade vendor names and warn each other about red flags

Facebook business communities that discuss pricing, reliability, and service experience in Thai

YouTube for walkthroughs, explainer videos, or informal feedback from other users

Thai-language blog posts and business media is usually where prospects often search in Thai and skip content that feels foreign

Peer introductions from colleagues or industry contacts who have worked with you before

We also ran a follow-up survey with one Thai client’s internal buying team. When asked what made them reply to an outbound message, these were the top three answers:

“We saw their case study featured in a Thai SaaS blog.”

“Our advisor had worked with them and said they were fast to respond.”

“Their LINE message looked like it was written for us, not just translated.”

Even something simple like adding a Thai-language customer story to your website can increase prospect’s confidence. They want context, social proof and want to feel like you’ve done your homework.

If your campaign doesn’t show up in the places they check, your message is more likely to be skipped, even if the offer is strong.

6. Navigating Thai Hierarchy: Targeting the right decision-makers for faster sales cycles

Many outbound campaigns begin by targeting the most senior person in the company.. Founders, VPs, Managing Directors. While this can work in Western markets, it often backfires in Thailand.

Job titles don’t always reflect who handles vendor selection in Thai companies. Especially in many mid-sized or family-owned Thai businesses, decisions often move through quiet internal networks. Senior leaders focus on high-level strategy, while mid-level managers quietly drive the process forward.

From what we’ve seen, it’s more effective to start with a thoughtful, respectful message to someone slightly lower in the hierarchy, someone who might be closer to the problem.

You won’t always know who that is, so the best approach is to:

Choose titles involved in the function you’re selling to (e.g., Sales Manager if you are offering a lead gen tool)

Use warm, localized language that doesn’t assume authority or urgency

Invite them to direct you to the right person, rather than pushing for a call immediately

This approach shows cultural awareness, avoids overstepping, and respects internal dynamics.

In Thai culture, skipping the hierarchy or messaging a CEO directly without context can cause kreng jai . Starting lower and moving up with permission tends to create smoother conversations and stronger buy-in.

7. Ensuring Compliance: Adhering to Thailand’s PDPA in lead generation campaigns

Thailand’s Personal Data Protection Act (PDPA) started strict enforcement in 2024. In Aug 2024, a Thai e-commerce company was even fined ฿7 million for not appointing a data protection officer and failing to manage consent properly.

Despite this, many outreach campaigns still run without checking whether their process meets legal requirements. That creates real risks for sales teams, especially those handling lead generation at scale.

With strict enforcement accelerating in 2025, companies must report data breaches within 72 hours to Thai authorities, and financial penalties can reach up to 5 million THB per violation. This has increased scrutiny around cold outreach practices, particularly for foreign companies operating without transparent data sourcing or documented consent processes.

Non-compliant campaigns now risk immediate reputational damage alongside legal exposure.

To meet PDPA standards, every campaign should follow basic rules:

Include clear sender identification in every message

Collect verified opt-in before running automated email sequences

Keep a record of where and how leads were sourced

Use respectful, permission-based follow-ups on chat platforms like LINE and WhatsApp

We’ve seen that Thai prospects are becoming more cautious, especially when receiving outreach from companies they don’t recognize. A message that feels intrusive or unclear can lead to being blocked, flagged, or ignored.

On the other hand, campaigns that show transparency and follow best practices tend to build trust faster. It signals professionalism, and it makes people more willing to engage.

Staying updated on BOI announcements and Thailand Board of Investment incentives can guide compliant targeting (e.g. companies applying for tax breaks in EEC or SEZ areas). Overall, Thai firms are becoming more cautious: foreign companies should expect more steps to verify prospect consent (double opt-in, visible privacy notices, etc) in 2025.

Final Thoughts: Mastering Lead Generation in Thailand

Don’t make these mistakes! Download our free Lead Generation Thailand Checklist to ensure your strategy is watertight.

Thailand is not a market where copy-paste strategies work. The language might be familiar, and the platforms might look the same, but user behavior is shaped by local habits, tone, and trust.

We’ve spent the last couple of months working closely with Thai clients and running campaigns for teams entering the market. That experience helped us understand what actually works, from cadence design and channel mix to tone, timing, and legal compliance.

If your outreach into Thailand isn’t getting replies, there’s usually a reason. Sometimes it’s the message. Sometimes it’s the structure. More often, it’s that the campaign wasn’t built with Thai buyers in mind.

We help sales and marketing teams localize the right way, without guessing and without wasting time on the wrong playbook.

If you want us to take a look at your current strategy, we are happy to review it and share what we’d fix or keep.

Reach out to us for a free consultation at contact@rev-empire.com

Table of Contents

- Why lead generation in Thailand is different

- 1. Understanding the Thai Market: Beyond generic lead generation strategies

- 2. Optimizing Outreach Timing: When Thai businesses are ready to connect

- 3. Cultivating Trust: Crafting personalized lead generation messages for Thailand

- 4. Leveraging Local Signals: Uncovering intent in Thailand's digital landscape

- 5. Earning Engagement: Building trust before expecting replies in Thailand

- 6. Navigating Thai Hierarchy: Targeting the right decision-makers for faster sales cycles

- 7. Ensuring Compliance: Adhering to Thailand's PDPA in lead generation campaigns

- Final Thoughts: Mastering Lead Generation in Thailand

Share on socials

FAQs about lead generation in Thailand

Why do foreign lead generation strategies fail in Thailand?

Foreign lead generation strategies fail in Thailand because they overlook relationship-based selling and local platforms like LINE. Thai buyers respond better to gradual trust-building, polite tone, and localized communication instead of direct, transactional outreach. Generic automation and copy-paste messaging often feel impersonal and get ignored.

What is the best time to send outreach messages for lead generation in Thailand?

The best time to send outreach in Thailand is between 1 PM and 4 PM on weekdays. This time window aligns with when Thai decision-makers actively check email, LinkedIn, and LINE, leading to higher visibility and better reply rates compared to mornings or late evenings.

How does Thai culture affect B2B communication and lead generation?

Thai culture values respect, hierarchy, and relationship-building. Effective B2B outreach requires a softer tone, proper greetings, and a gradual approach before suggesting meetings. Direct pressure or aggressive sales language can harm trust and reduce engagement.

What is Thailand’s PDPA and how does it impact B2B lead generation?

Thailand’s Personal Data Protection Act (PDPA) regulates how businesses collect and use personal data. For B2B lead generation, it requires clear sender identity, consent-based contact, and traceable data sources. Non-compliance can lead to legal penalties and loss of credibility with Thai prospects.

What are the biggest lead generation challenges for startups entering Thailand?

The biggest challenges include misunderstanding buyer behavior, using foreign sales scripts, ignoring local platforms, and underestimating trust requirements. Startups that adapt messaging and outreach strategy for Thailand see faster traction. For practical guidance, explore our resource on Startup Sales in Thailand.